Thousands of dollars extra in retirement savings thanks to July super boost

Nearly 10 million Australians will get an automatic boost to their super from 1 July – a change that will mean thousands of dollars more in retirement savings.

The Superannuation Guarantee rate will rise from 11.5% to 12%, meaning an extra $317 in super contributions will be paid to the average Australian worker next financial year.

Young Australians and low-income workers will be the biggest winners from the increase.

The 0.5 percentage point increase alone could see a typical 30-year-old retire with $22,000 more in super. Taken together with the full increase from 9% to 12% over the past decade, it could add up to $132,000 in extra superannuation savings by retirement.

Ahead of the July 1 super rise date, new analysis from the Super Members Council of tax data reveals:

- Around 10 million people will get a super boost this year – split almost evenly between men and women.

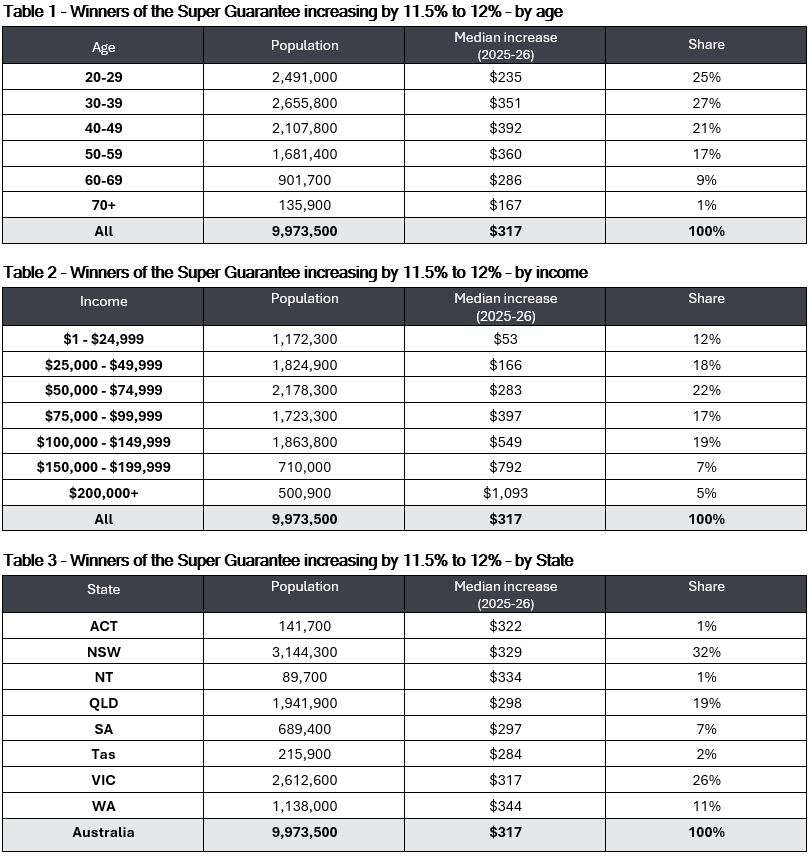

- More than half of the people getting the increase are under 40 years old – and more people in their 30s will get a boost to their retirement savings than any other age bracket (Table 1)

- Almost a third of the people getting the increase earn less than $50,000 per year and around 70% of those getting the increase earn less than $100,000 a year (Table 2)

- The average West Australian will get an extra $344 this year, the highest average super boost of the States (Table 3)

The Super Guarantee is key to funding the retirement of Australia’s ageing population.

Before compulsory super was introduced in 1992, only 10% of retirees listed super as a source of income. Now, about 90% of people aged between 30 and 50 have super.

As more people start to retire with super, it significantly reduces pressure on the taxpayer-funded age pension. Already, the proportions of people on the full- and part-pension are declining steadily and super now pays out more than twice as much each year in benefits than the Age Pension.

The Intergenerational Report shows that, despite a doubling of over 65s by 2063 and a trebling of those aged over 85, Australia’s Age Pension spending will fall from 2.3% of GDP to 2% by 2062/63, even as other costs associated with an ageing population continue to rise.

Super Members Council CEO Misha Schubert said the super rate increases were key to delivering a life in retirement that Australians deserved after a lifetime of hard work.

“This boost to retirement savings will help fund the things that matter most – more help with paying the bills, spending time and making memories with the family, trips away and financial security,” she said.

“More super means more freedom, more choices and more opportunities to do the things you love.”

“Our super system is the envy of the world because it lifts the retirement savings of everyday Australians, takes pressure off the taxpayer-funded pension, invests capital to grow Australian jobs and companies and – most importantly of all gives millions of Australians a better life at retirement.”

“When you know that a 30-year-old today will be more than $130,000 better off in retirement, it underlines why the safeguards that protect super for retirement are so important for all Australians.”