When our modern superannuation (super) system was designed, its sole purpose was to save money for Australians’ retirement. And preservation has long been key to that.

Addressing the short-sightedness people have about their finances, preservation is the requirement to leave your super to grow until you retire. The government even ‘thanks’ us for doing so by taxing these savings at just 15%.

As one of three key principles of super – alongside being compulsory (automatically paid) and universal (for all workers) – preservation is a simple, successful principle that’s seen our system become one of the world’s leading retirement schemes.

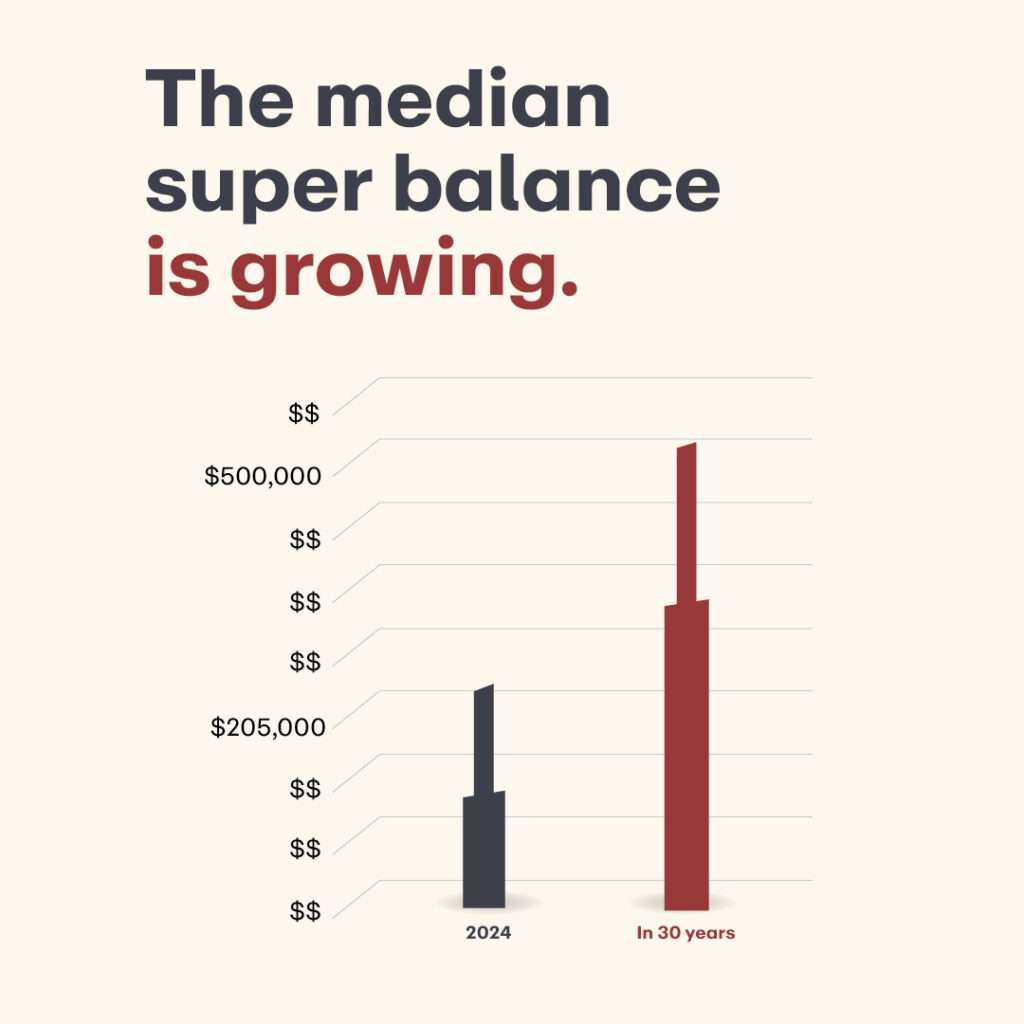

It’s why Australians are now retiring with an average of $200,000 in super savings, which will grow to about $500,000 by 2055.1

The magic of compound returns

There are few schemes you could count on to grow your money by 150% in 30 years. But that’s the power of compounding.

When the returns (or earnings) you make from your super investments are reinvested, they too start earning returns, called compound returns.

This snowball effect on your wealth is the superpower of super

Because your super is preserved, the money is automatically reinvested. And the longer you leave it invested, the larger the returns, and the faster your balance grows.

Super at work

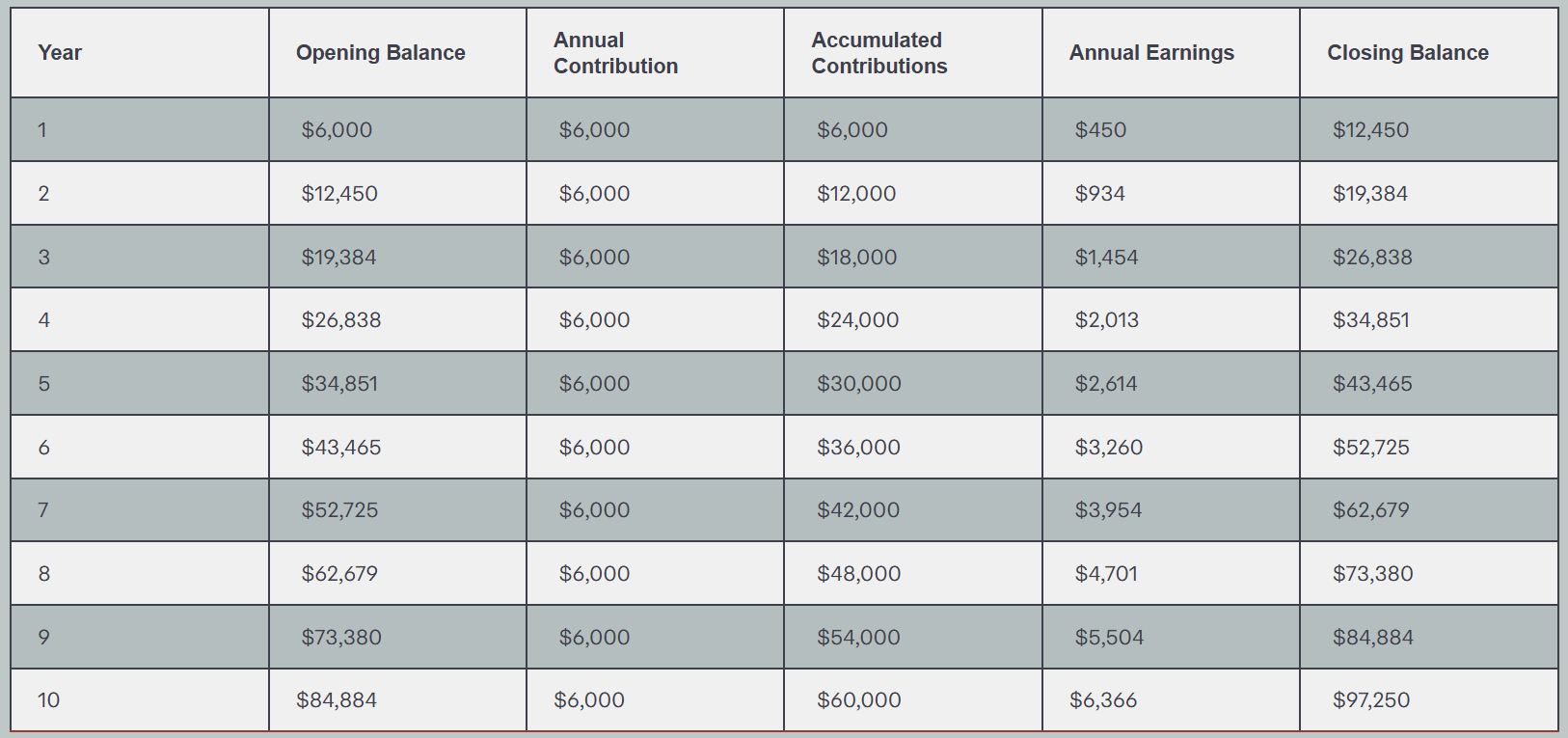

Laying these figures out truly makes the magic of compounding real.

The table below shows how an annual contribution of $6,000 could mean a balance of close to $100,000 after 10 years preserved in super. For this example, we’ll assume earnings of 7.5% a year and no fees or charges.

A decade of these contributions amounts to $60,000. But because the earnings are reinvested, this figure grows exponentially, adding an extra $37,250 to the super balance.

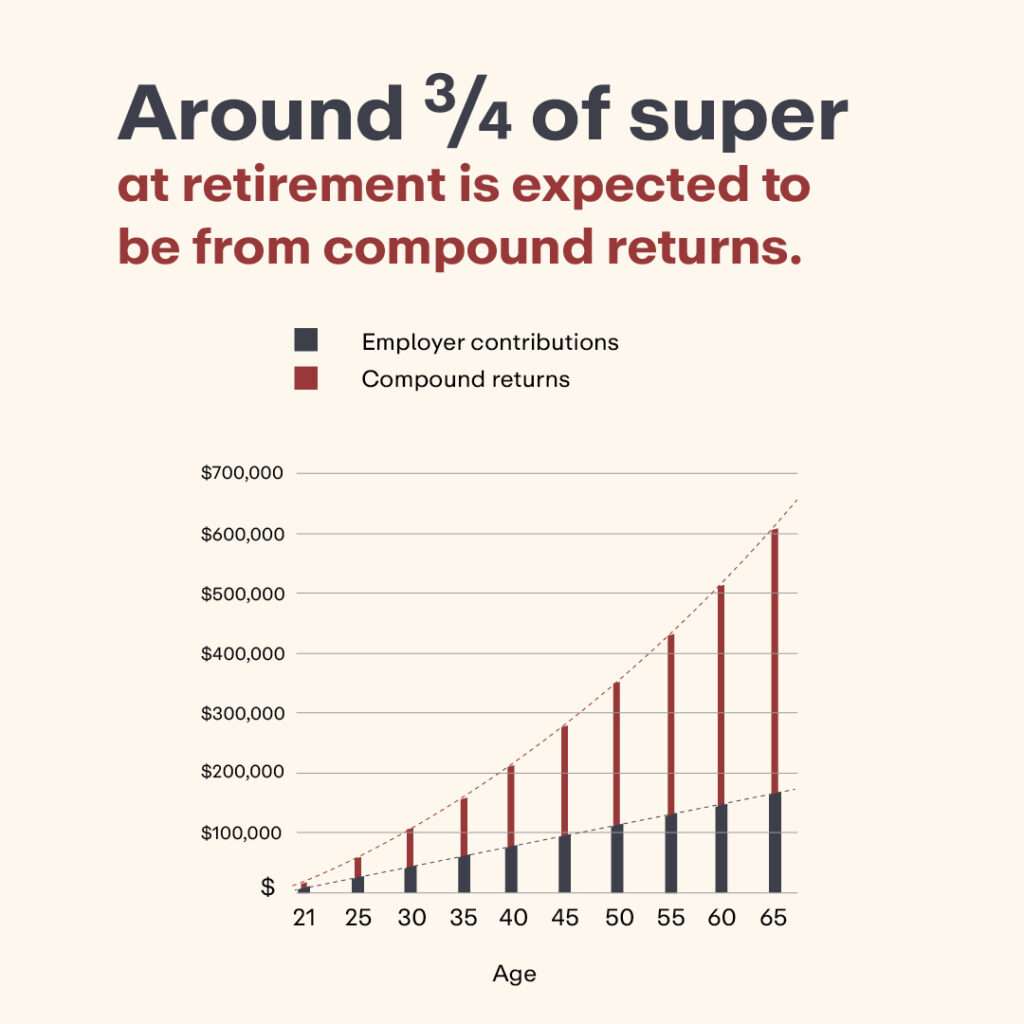

Compounding is so effective, up to three quarters of your super balance at retirement will likely come from earnings on your contributions.2

Getting your super

Compound returns is reason enough to keep super preserved.

For most people, super is preserved until you turn 65, or you reach your ‘preservation age’ – between 55 and 60, depending on when you were born.

Accessing superannuation early is only possible in very limited circumstances including medical, compassionate and severe financial hardship grounds.

You can however access some of your super if you’re saving for a first home through the First Home Super Saver scheme (see below) – but access is only given to additional contributions put aside for the purchase of a home. You can also access an income stream from your super before preservation age, using a transition to retirement (TTR) strategy.

Many people are unaware you can keep your super growing, even at retirement age

Accessing super while you’re still working

If you’re not ready to stop working at preservation age, a TTR can help you ease into retirement.

A TTR lets you draw an income from your super if you want to reduce your working hours, or boost your super and save on tax while you keep working full time.

It’s currently a complex strategy that means opening an additional retirement super account alongside your regular super account. The Super Members Council (SMC) supports simplifying super rules so you can have just one account that does both, which would benefit around 100,000 retirees.

Of course, withdrawing superannuation as a lump sum is an option at retirement. While you won’t pay tax on withdrawals after 60 years of age (those under 60 are taxed at 22%), the benefits of compound interest will be lost and your balance will stop growing.

Using super to buy your first home

If you’re saving for your first home, you can use the super system to grow your deposit, under the First Home Super Saver (FHSS) scheme.

The scheme enables you to put savings toward a home into super, taxed at just 15%. Then apply to withdraw those savings to put towards a first home deposit when you’re ready. Eligibility criteria, savings limits and release conditions apply.

Watchouts: The risks of claiming super early

Proposals to change access rules undermine the super system as we know it. We already learned some lessons of early release after COVID.

Using super to purchase housing – one proposal suggests withdrawing superannuation money to put on a first home. But this involves raiding existing retirement savings (rather than using super to help save towards a deposit through the FHSS).

These proposals would only increase house prices, reduce retirement savings and weaken our world-class super system.

Using super to pay for non-essential medical procedures – withdrawing super early is possible on compassionate grounds where treatment is essential. But some dental and medical providers are encouraging misuse of the scheme, leaving Australians considerably out of pocket.

Not only does this drain super balances for non-essential expenses. Accessing superannuation early also has substantial tax implications.

COVID-19 Early Release of Super scheme – early in the COVID pandemic (before JobKeeper assistance was announced), the government encouraged withdrawing money from super. And now we know the cost of the scheme.

Almost $38 billion was withdrawn, mostly by younger workers. This will cost the federal budget twice as much – about $85 billion – namely in higher Age Pension costs.

Thanks to COVID early release, a generation of young Australians has lost the lifetime power of compound returns

Super at work

Rose is 30 and took out $20,000 from her super during COVID for non-essential cosmetic surgery.

Thanks to compound returns, if Rose had left this money in super, she would have an extra $93,000 at retirement.

The benefit of preservation is as strong today, as when our super system was established. SMC will continue to advocate for our super principles to remain. Because when we leave good policy that works as designed, all Australians benefit.

FAQs

-

Why isn’t accessing my super early allowed?

Super has always been your money for retirement. The longer you leave it, the more it earns, and the more you’ll have when you stop working.

-

Why did the government allow access to super during COVID?

Before JobKeeper was announced, Australians were encouraged to sacrifice their super savings to support themselves during COVID. The short-sighted decision will now leave many people significantly poorer in retirement.

-

If I access super early, can’t I just catch up later?

No, because of compounding returns, what you withdraw now can cost up to four times more by the time you retire, so you’ll always be behind.

-

What age can I access my super?

Most Australians will be accessing superannuation at 55 to 60 years of age, depending on your preservation age. Getting super early is possible only in exceptional circumstances.

References:

1. SMC Modelling

2. Estimate based on SMC modelling. Assumes 44 continuous years’ full time working on median income and employer contributions to super.

The information set out on this website is of a general nature only and should not be taken as a complete or definitive statement about superannuation. You should not make decisions concerning your superannuation arrangements solely based on the information contained on this website which has been prepared without taking into account your objectives, financial situation or needs.