While you work, your superannuation (super) is working to improve life in retirement. It’s also working more widely to power Australian businesses and the economy.

This compulsory savings system was created to ensure Australians build wealth over their working lives through regular employer contributions. But retirees didn’t always benefit.

In 1970 before super became compulsory, only 30% of workers had super and the average person retired with no savings1. Most relied on the Government Age Pension to live on, which is a minimal amount of money. Singles are currently entitled to $1,149.00 per fortnight, and couples combined $1,732.20 per fortnight, including pension and energy supplementary payments.

A super supplement to the Age Pension

Super was never designed to totally replace the Age Pension.

The extra money super provides can help retirees enjoy holidays and meals out, renovate the home and buy gifts for grandchildren. For many, it means the difference between financial survival and financial security.

You can have substantial super savings and still receive the Age Pension

Having super doesn’t stop you receiving the Age Pension. Many people with super receive a full or part pension depending on the value of their assets, while some will have enough super and won’t need it at all.

The benefits of super keep growing

The average super balance Australians are retiring with is still increasing, because our super system is still maturing.

Australian super balances are still on the rise

Not only because the amount employers contribute to super has increased over time (with national superannuation rates rising from 3% of wages in 1992 to 12% of wages by 1 July 2025). But because our savings are preserved until retirement. This means most people retiring today have built their super balance over 30 years.

The median super balance is rising to life-changing sums:

• In 2025, Ian will retire with 33 years of super savings – around $200,0002.

• In 2055, Nassim will retire with 40+ years of super – around $500,000 in super3.

Even those earning the minimum wage throughout their working lives can expect to retire with an income 35% above the Age Pension thanks to super.

Super saves all Australians on tax

As Australian super contribution rates and balances go up, demand for government-funded pensions goes down. And that means our taxes can be diverted to other essentials like healthcare and schools.

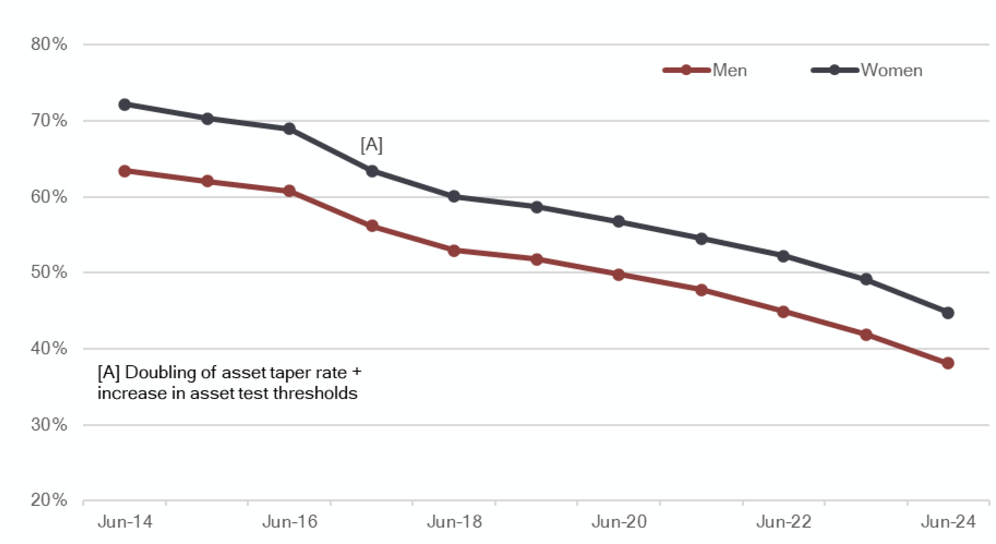

The number of Australians aged 67 years (the age you can access the Age Pension) relying on any public support has already fallen – from 68% in 2014 to just 42% in 2024.4 Driven mostly by growing super balances, people are now retiring with more private savings.

Australians aged 67 on the Full Age Pension, 2014-24

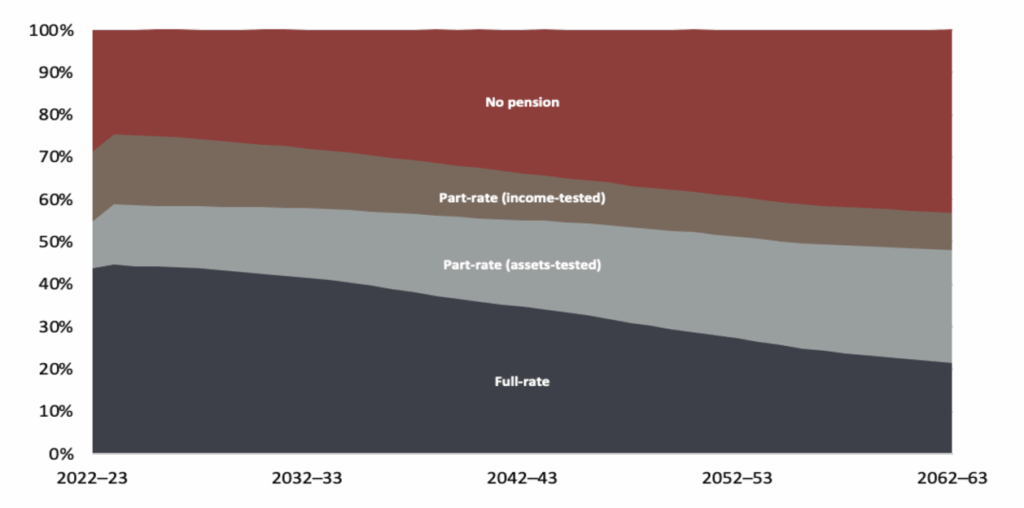

This downward trend is projected to continue with the number of Australians receiving the full rate Age Pension halving from 44% today to 22% in 2062-63.5

Australians receiving the Age Pension, 2022-63

This means Age Pension costs will remain sustainable in the future and likely fall over time relative to the size of our economy.

A model system

Australia’s retirement system has been described as a model for modern economies.6

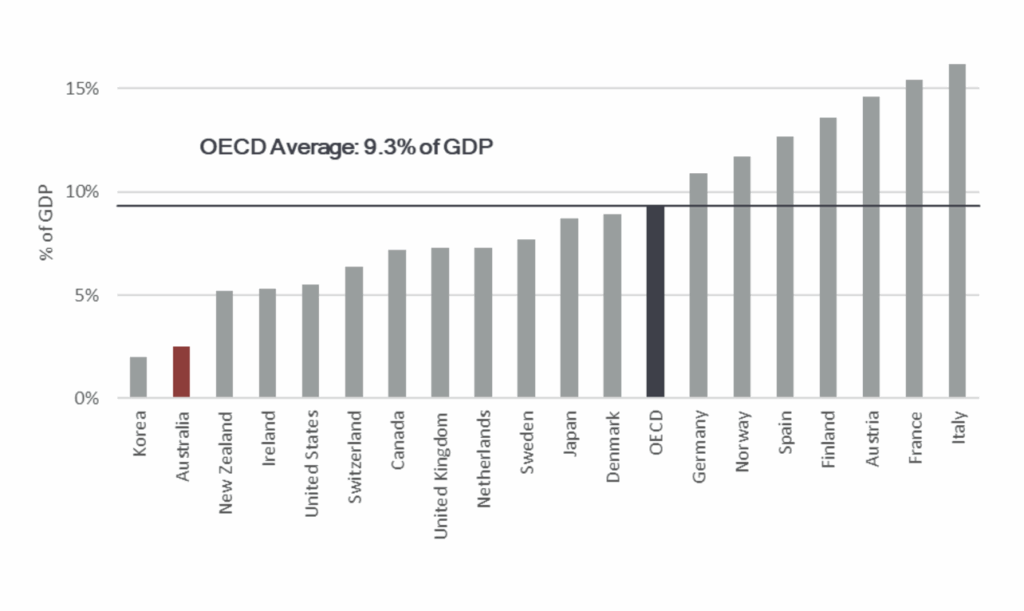

Super makes us one of the least dependent OECD (Organisation for Economic Cooperation and Development) nations on government-funded pensions, despite our ageing population.

Projected public spending on the Age Pension – selected OECD countries, 20257

Even as the average superannuation at retirement keeps growing, spending on our Age Pension is expected to keep falling.

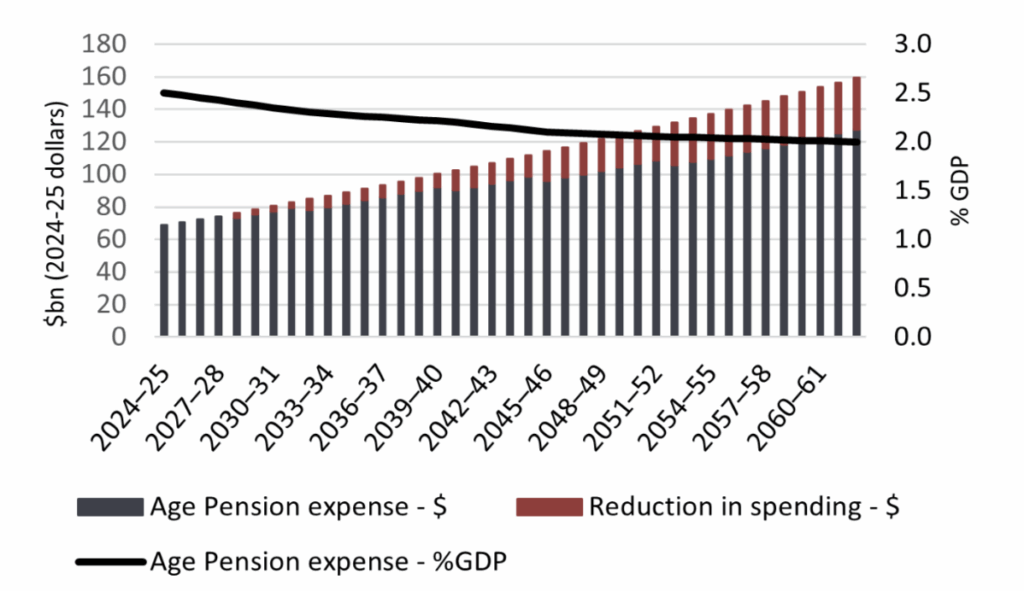

Super means less cost to the federal budget

If spending on the Age Pension falls as projected,8 the Super Members Council (SMC) estimates around $500 billion will be shaved off the federal budget – with spending falling from 2.5% of gross domestic product (GDP) in 2024-25 to 2% – by 2060.9

Projected Federal Government spending on the Age Pension

Some people argue that due to tax concessions, the cost of super outweighs savings to the federal budget and so the amount employers are legally required to contribute to super should be reduced.

The idea that tax concessions offset any savings on Age Pension costs is a myth

But this simplistic argument doesn’t consider the cost of increasing the Age Pension to meet the average retirement income Australians currently receive through super in combination with the Age Pension.

A couple on median earnings throughout their working lives will enjoy an income in retirement of around 50% higher than the maximum Age Pension, thanks to super.

If the Age Pension was increased to deliver comparable living standards to the average income under super, the federal budget would likely be $100 billion worse off each year, and spending on the Age Pension would double by 2032.11

Super is a boon to the Australian economy

Our super system also gives everyday Australians the benefit of investing in large projects, which few of us could ever do alone. By pooling all our savings, super offers access to expert investment minds that help drive our economy.

Super in Australia invests in:

Our national and local economy – to the tune of $82 billion each year. In the next five years, profit-to-member super funds (where profits go to members rather than shareholders) are projected to invest another $180 billion in Australian businesses and infrastructure.12

Diversified assets. Before super, very few Australians owned equities – now we’re a nation of Mum and Dad shareholders.

New and growing businesses. Super venture capital is increasingly financing local startups, and helping established companies to grow.

Local infrastructure. Within five years, super funds are tipped to invest $31 billion in Australian road, rail, sea, air and renewable energy projects.13

Australian jobs. All this investment brings more employment opportunity for more Australians.

That’s the beauty of patient capital. Our super system is focused on the long-term, supporting Australians, and Australian businesses for decades to come.

FAQs

-

Is super making a difference to people in retirement?

Yes. Before the modern super system, most people retired without savings. As national superannuation rates have continually increased, the average superannuation at retirement today is $200,000 – which if left in super, can continue to grow and provide an income in retirement.

-

Is super reducing reliance on the Age Pension?

Yes. Rising Australian super rates mean people are now retiring with more private savings. The number of Australians who draw any type of Age Pension at retirement (age 67) has fallen from 68% in 2014 to just 42% in 2024.

-

Does super work for lower-income Australians?

Yes. Those earning the minimum wage throughout their lives can expect to retire with an income 35% above the Age Pension.

-

Is super saving taxpayer money?

Yes. Australia is one of few countries whose spending on the Age Pension relative to GDP is falling. Despite an ageing population and national superannuation rates rising, super will save the federal budget an estimated $500 billion by 2060.

-

Does super help our economy?

Yes, super funds invest in startups and infrastructure. And because super keeps investing, this helps keep our economy resilient even when economic times are tough.

-

Why can’t I access my super before retirement?

Super is designed to build savings for when we exit the workforce. By leaving savings in your account until then – and as Australian super rates have risen – the typical super balance at retirement has grown, providing you with a higher standard of living.

References:

- Retirement Income Review – Final Report

- Calculation based on 2022-23 ATO tax file

- Projection based on model of median wage

- Department of Social Services 2024, Australian Bureau of Statistics 2024

- Intergenerational Report 2023

- Larry Fink, Black Rock 2024

- OECD Pensions at a Glance 2023

- SMC analysis of Intergenerational Report 2023

- This is a conservative estimate and does not consider the impact on rising pension costs should changes to current super system settings lead to an increase in reliance on the Age Pension in future years.

- SMC analysis

- Estimations by the Parliamentary Budget Office

- SMC analysis

- SMC analysis

The information set out on this website is of a general nature only and should not be taken as a complete or definitive statement about superannuation. You should not make decisions concerning your superannuation arrangements solely based on the information contained on this website which has been prepared without taking into account your objectives, financial situation or needs.