Why talk about super?

Because super works in the background until the end of your working life, it can feel a bit out of sight and out of mind.

Add to that the fact that nearly three-quarters of workers today weren’t in the workforce when super was legislated 32 years ago. Back then it was a big deal – most workers were retiring with little in savings and instead relied on the age pension.

Understanding super is important. Research shows the more you understand it, the more you ensure it’s working for you. Informed superannuants make better decisions about, and feel more satisfied with, the performance of their super.

A better collective understanding of our super system also means we value the benefits it provides and are more likely to improve it for everyone and safeguard it for future generations.

Learn more about super:

Superannuation basics and history

Parts of the superannuation system

Accessing your super

Managing your super

Growing your super

Improving super

Retiring with super

FAQs

-

What is super?

Super is money set aside to support you in retirement. It is money paid on top of your wages into a superannuation account and invested for you.

Currently, employers pay 11.5% of your wages directly to your super fund. This is called the superannuation guarantee and has increased incrementally over the years – starting at 3% in 1992.

On 1 July 2025, the amount your employer contributes will increase one final time to 12% of your salary.

Super is not part of your wage – it’s paid by your employer on top of your wage. -

Is super compulsory?

Many people find it difficult to save long-term and tend to prioritise spending now rather than saving for the future. That’s why super was made compulsory – to make sure everyone saves.

But not only that – everyone’s savings are then invested to grow, all for your retirement and without even having to think about it. Super is a right for most Australian workers, and about 90% of workers today have super. -

If super is paid by my employer – do I pay tax on it?

Compared to other income super paid by your employer is lightly taxed at 15%. This rate of tax on contributions to your super is much less than the average rate of tax Australians pay on their wages – which is around 25%*. It’s the government’s way of saying ‘thank you’ for keeping our savings for retirement.

(*OECD, Taxing Wages 2024) -

What’s the secret to super’s success?

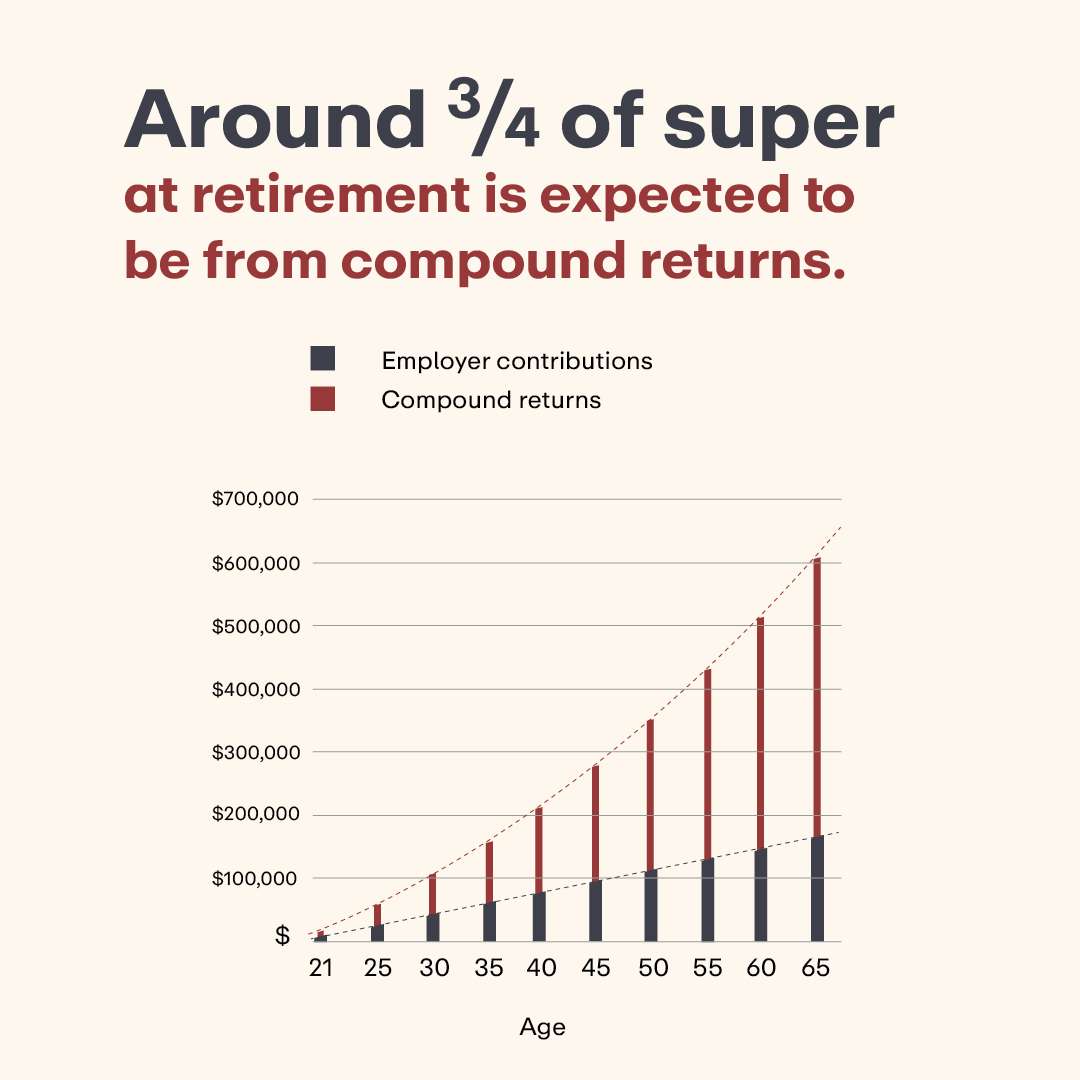

The secret to super is something called ‘compounding returns’. This is where the returns you can make from your super investments are reinvested, so the returns can also start earning returns. The longer you leave your super invested, the larger the returns can become and the faster it’s likely to grow.

So much so that by the time you reach retirement up to three quarters of your super balance will likely be made up of earnings on your contributions*.

That’s the power of compound returns.

(* Estimate based on SMC modelling. Assumes 44 continuous years full time working and employer contributions to superannuation. Uses the median income percentile.) -

Is the super system working?

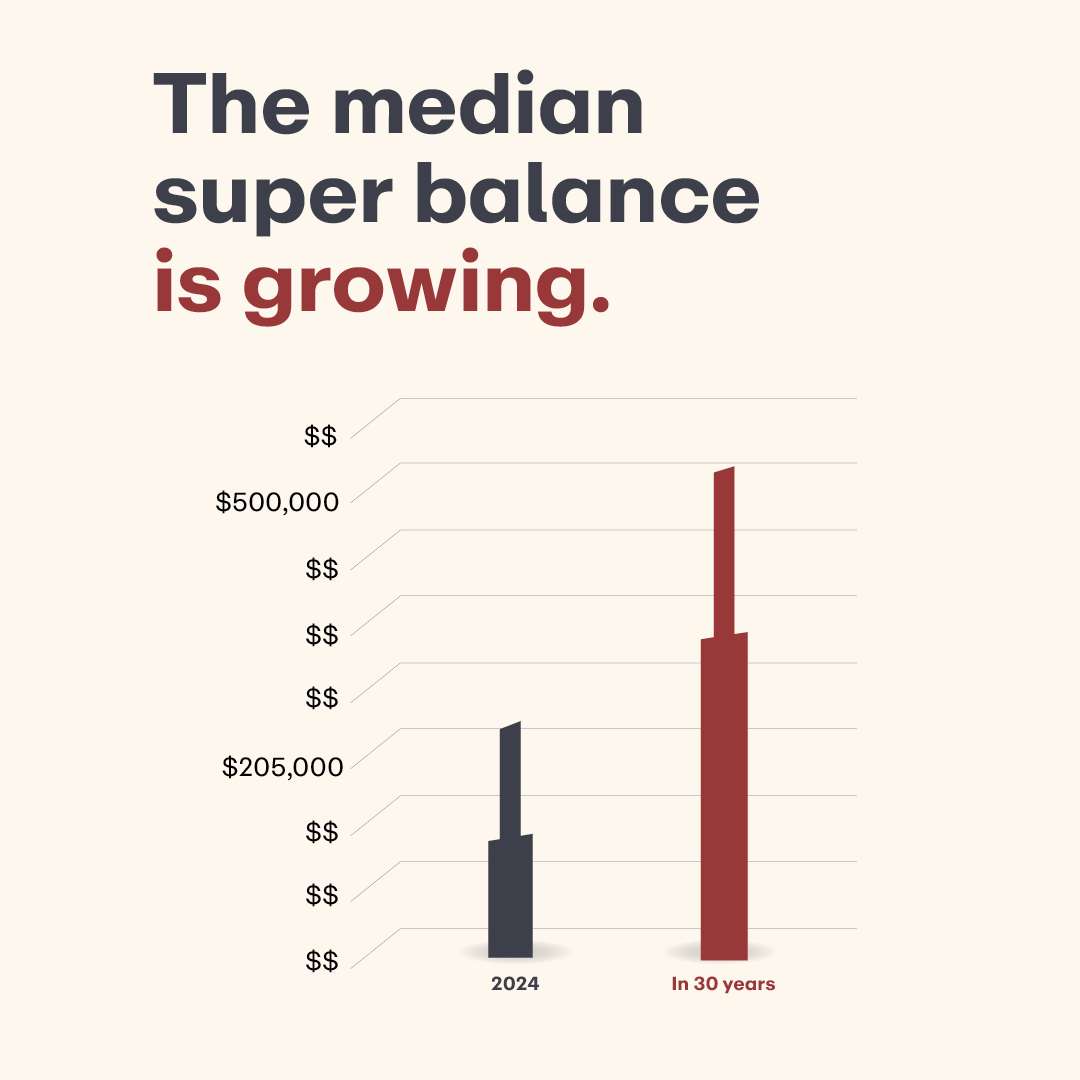

Before compulsory super was introduced in 1992, the typical Australian worker retired with no savings. Today the typical worker retires with around $200,000*. In another 30 years the typical worker will be retiring with about $500,000~ in their super fund. These are life-changing sums.

The median super balance is still growing because our super system is still maturing. The amount employers contribute to your super has increased over time, from 3% of wages in 1992 to 12% of wages by 1 July 2025. And most people retiring today have been contributing to super for 30 years. Only by 2032 will we see people retiring with 40 years of superannuation savings.

(*Figure based on calculation using 2022-23 ATO tax file.)

(~Figure based on a cameo model of a typical worker on median wage.) -

Will having super mean I’m ineligible for the age pension?

Having super does not automatically exclude you from the government’s age pension. That’s because super was never meant to replace the age pension – only supplement it. Many people will continue to receive the age pension alongside their super. For example, some people with super will receive the full pension, and depending on how much super they have, some will receive a part-pension. And some will have enough super they won’t need the age pension.

By supplementing the age pension, super can improve the quality of our lives in retirement. That could mean more holidays, more meals out, and more treats for your kids or grandkids.

And with super, the cost of the age pension remains more sustainable into the future – in fact over time the cost is likely to fall relative to the size of our economy. A sustainable age pension as our population ages means our taxes can continue to be spent on other essentials like healthcare and schools.

The age pension is one of the three pillars of our retirement system (along with super and personal savings outside super).

-

How does our super system compare internationally?

Australia has the 55th largest population but the 4th largest super system*.

The 2023 Mercer CFA Institute Global Pension Index, which ranks 47 retirement systems and covers 64 per cent of the world’s population, ranked Australia’s superannuation system 5th, just behind the Netherlands, Iceland, Israel and Denmark~. In a 2024 letter to investors, Larry Fink, Chairman of one of the world’s biggest investment companies based in the United States – Black Rock, profiled Australians retirement system as a model for other modern economies.

(*OECD, Pensions at a Glance 2023, p 222).

(~https://www.mercer.com/insights/investments/market-outlook-and-trends/mercer-cfa-global-pension-index/) -

A brief history of super

Superannuation Guarantee legislation became law in 1991. This legislation introduced compulsory superannuation for the first time in Australia and in 1992 employers made their first superannuation contribution to workers, which at that time was 3% of wages.

Since then, the rate of contributions has increased incrementally, reaching 11.5% of wages today and will increase one more time to 12% on 1 July 2025.

Because super is still only a little over 30 years old and the rate of contributions has been incrementally climbing over time, we’re yet to see workers retiring today who have received a full working-lifespan of superannuation contributions – certainly not contributions of over 9% for any length of time. That means the full effect of our superannuation system is still yet to be seen.

Regardless, thanks to compulsory super, coverage has increased from 30% of workers in the mid‑1970s to 90% today. And today Australians are reaching retirement with a median balance of about $200,000. As the system matures this will hit $500,000 in another 30 years. Australia’s super system is already valued at $3.9 trillion*, a figure that will also grow substantially in time.

As the system matures and progresses toward its full potential, it’s only natural to want to keep on improving it to ensure as many people as possible are benefitting and as fairly as possible from super, and that the system is operating as effectively and efficiently as possible. SMC was established in 2023 as an advocacy body for consumers of profit-to-member funds with exactly that aim.

Superannuation savings are today managed by investment professionals, the system is highly regulated to ensure all those savings are managed appropriately, and the fees charged for managing your savings have continued to fall over time ensuring the system works efficiently.

(*As at March 2024, APRA Quarterly Performance report) -

Weren’t we able to access our super during COVID?

In the early stages of the COVID pandemic, before JobKeeper assistance kicked in, many Australians were encouraged to sacrifice their retirement savings to support themselves.

Instead of the Government providing financial help, people were encouraged to help themselves by taking out money they’d been setting aside for later in life.

Unfortunately, about 725,000 Australians effectively wiped out their superannuation accounts – of these, 45 per cent were aged 25 and under, and 70 per cent were aged 30 and under. While some of these people used the money to make ends meet, evidence suggests a sizeable proportion of the money was also spent on non-essential items.

Those who did remove super will end up with much smaller superannuation balances when they retire. And because money in super compounds over time, so too do the losses.

SMC analysis shows a 30-year-old who withdrew $20,000 from super at that time could be left with about $93,600 less at retirement – leaving them dramatically worse off in their lifetime.

And because of the size of compounding effect, it’s very difficult to catch-up later.

People who accessed their super before retirement are now projected to need to draw more heavily on an age pension. -

What’s this proposal to allow people to access their super to buy a house?

Houses in Australia are increasingly unaffordable and it’s understandable many first home buyers are looking for any way to get a foothold in the market.

While the idea of using super to buy a house sounds appealing at first glance – a closer look reveals it’ll only make houses more expensive, while leaving those who use their super worse off at retirement.

Economists like Saul Eslake agree: when buyers have access to more money in a supply-constrained market, it pushes up prices. SMC modelling shows it could push up prices by about $75,000 across capital cities, far higher than the typical amount of super most first home buyers would be able to access.

On top of making housing more expensive, it will also cost people their retirement savings. SMC modelling shows a 30-year-old couple who withdrew $35,000 each from their super today could retire with about $195,000 less in today’s dollars.

As soon as one person accesses their super to buy a house, everyone will need to access theirs just to stay in the race to buy a home.

We’ve seen the consequences of an idea like this across the ditch in New Zealand, where Kiwis can withdraw their super for a house deposit. Not only did house prices surge – but home ownership rates actually fell, particularly for people in their thirties.

And because more of the Kiwi super pool needs to be on-call to cover withdrawals for house deposits, the New Zealand system can’t invest as much of their super in long-term, higher-return investment options. This hurts everyone, with the average 30 year-old Kiwi calculated to have about $130,0000 less than the average Aussie by retirement. -

Why would accessing super push up house prices?

A key reason house prices have been rising in Australia is demand has consistently outstripped supply for a long time.

Whenever demand exceeds the supply of a good or service, it pushes up prices, and when more money is available to buyers in these circumstances, it pushes up prices at an accelerated rate.

Picture two first buyers at the same auction, both hoping to buy the same house, both having access to their super balances. It’s not hard to imagine the result! -

How does the Super Guarantee rising from 11.5% to 12% on 1 July 2025 affect working Australians?

This increase refers to the minimum amount your employer pays into your super account, on top of your wages.

For working Australians, this seemingly small increase marks the end of a 14-year journey that began under the Rudd-Gillard Government to lift super payments from 9% to 12%.

The 12% milestone ensures Australians’ have an adequate standard of living in retirement, with the typical retirement balance expected to hit $500,000 in the next 30 years.

This increase to the SG is a powerful step forward for Australians’ financial futures.

Want to learn more?

This advice is general or factual in nature only that is not intended to influence financial decisions, including investment or withdrawal from superannuation. It is not financial advice about a particular superannuation product or class of superannuation products.

Consider a fund’s Product Disclosure Statement (PDS) and your personal financial situation, needs or objectives, which are not accounted for in this information, before making an investment decision. Authorised by Super Members Council of Australia Ltd, ABN 64 671 146 688.