Australia’s superannuation (super) policy was designed to work well, even for those who are less engaged. And more than 30 years after our modern system was established, it’s one of the most effective retirement schemes in the world.

But while your super money grows unassisted, a little assistance from you while you’re working could mean a whole lot more in retirement.

Why manage your super?

We know the snowball effect compounding has on your super – that is, your reinvested returns earn compound returns, making your money grow.

It’s the same with decision-making. Because the impact of your super decisions compounds over time, it’s never too soon to start making good choices for your retirement savings.

And that starts with choosing the right fund.

Choosing a good super fund

Your super fund is your choice. And selecting the right fund could make a significant difference to your balance at retirement.

Some workers consider changing funds when they change jobs, because a new employer will ask you to name a fund. You can list your existing fund, switch to the employer’s fund, or choose a different fund altogether. If you don’t make a choice, your super will be paid into the company’s default MySuper option.

While there are many types of super funds, be mindful that not all funds have good long-term returns.

What to look for when choosing a fund

A few key fund features can hugely impact your retirement savings. So look for:

Long-term performance. Super is long-term investment strategy, so focus on strong, long-term performance rather than short term spikes.

Low fees. The most common fees include admin and management fees. While the amounts may seem low, these annual costs can eat into your future savings.

A fund run to benefit its members. Funds that return profits to members rather than shareholders have delivered better long-term returns for their members.

All of the Super Members Council member funds are profit-to-member funds. You can learn more about the SMC member funds here.

A small difference in fees or performance makes a big difference over the long term. Analysis by SMC shows a 1% higher fee or lower investment return p.a. can equate to up to $128,000 difference in balance at retirement (age 67).

Checking for unpaid super

While super from your employer is legally required, and should be automatically applied, it’s important to check your contributions regularly.

Modelling from Super Members Council shows Australians missed out on $41.6 billion in unpaid super between 2013 and 2022.4 On average, that’s $1,800 less for every affected person – which can mean being $30,000 worse off in retirement.5

Currently, your employer only needs to pay super quarterly, which delays the growth of your balance from compound returns. Legislation has been introduced that will mean from July 2026, they’ll need to pay on payday alongside your wages – which should significantly reduce the scale of the unpaid super scourge.

Finding lost super

If you’ve changed jobs or moved homes, it’s easy to ‘lose’ your super. But it’s just as easy to find it again.

Super is classified as lost when your fund is inactive (without contributions or rollovers for five years). Or when you’re considered uncontactable (no contributions or rollovers for 12 months, and your fund has no current contact details for you).

You can find lost super with the ATO.

Consolidating your super

If you or your employers set up a new super account with a new job, you can end up with multiple funds, and fees.

But you can consolidate your super into one account, in just three steps:

1. Find your member number for each account you want to roll over (some funds only require your Tax File Number instead).

2. Log in to the website of the super fund you want to keep.

3. Search ‘consolidate’ and enter the details of the accounts you want to roll in.

If your chosen fund asks if you want them to look for lost super, it’s a good idea to say yes

Super at work

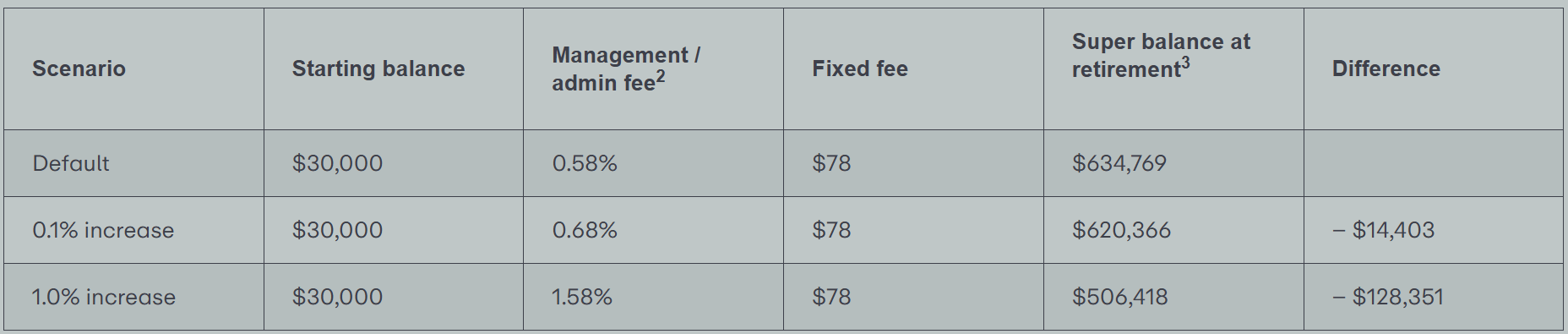

Ben, aged 30, has a super balance of $30,000 and plans to retire at 67.1

The table below shows how a 0.1% increase in fees could make him $14,000 worse off at retirement. While a 1% increase could see him miss out on $128,000 at retirement.

Fees and performance aside, there’s more to consider when choosing a super fund:

- Insurance. Some super funds offer no, or limited, insurance options. Be sure to check available cover, especially for higher risk jobs like construction.

- Investment options. All super investments carry a level of ‘risk’, that is how much the value of your investments may go up or down over time. Generally, higher risk options offer potential for higher returns or losses. While lower risk options will likely deliver lower returns or losses.

- Services. Member services can vary between super funds. Consider what’s important to you, like online account management or financial and retirement planning advice.

Comparing super funds

Online tools make comparing super funds easy.

To see how different funds stack up in terms of performance, fees and ratings, visit the Australian Taxation Office (ATO), or credible non-government sites such as Canstar, Chant West or SuperRatings.

Switching super funds

It’s your right to change funds, if you choose to.

First, check for any benefits (like insurance) you may lose, or higher fees you may pay. Exit fees for moving funds or withdrawing super were banned by the Federal Government in 2019.

To switch, just open an account with your chosen fund, and ask them to ‘roll over’ (transfer) your account balance. Or, you can roll over your super with the ATO.

If you’re with an underperforming MySuper product, you’ll be notified by the financial regulator, the Australian Prudential Regulation Authority. APRA conducts annual performance tests on these products (excluding funds designed for the retirement phase), but it will be up to you to switch to a better performing fund.

Getting advice on your super

Super can feel like a complex concept. But good advice can help you manage your money.

Many funds offer free general advice, or fee-for-service financial advice. Reforms have been proposed by the Government that should help more members access the guidance they need to plan retirement with more confidence.

73% of Australians support super funds being able to give them more information on pension eligibility and household financial circumstances to help them have a clearer picture of retirement.

As we await these crucial reforms, trusted organisations like the Super Members Council can provide a source of super information for all Australians.

FAQs

-

Can I really make changes to increase my super balance at retirement?

Yes. While the system works even if you don’t engage with your fund, there are small changes you can make now – like choosing a lower fee fund and consolidating multiple super accounts – that can make a big difference when you retire.

-

Why haven’t I been paid my super?

While employees must pay super by law, unpaid super is a growing issue – with 2.8 million Australians missing out on $5.1 billion in super in 2021-22.6

Part of the problem is that super only needs to paid every three months, and the Federal Government is working to fix this by introducing payday super in 2026.

To claim unpaid super, get in touch with your fund or contact the ATO. -

How can I find my old super accounts?

It’s easy to ‘lose’ your super if you’ve changed jobs and opened new accounts. Or if you’ve moved home and your fund doesn’t have your contact details. But you can find lost super with the ATO.

-

Why should I consolidate my super?

Having more than one super account means having multiple sets of fees – and the costs add up over time. But you can consolidate your super online with your chosen fund.

References:

1. For this example, we assume a full wage earner in a continuous career, a median income (RIR 50th percentile worker, non-gender stratified) adjusted for wage growth in today’s dollars, and a 7.50% rate of return for the accumulation phase, after tax.

2. Asset-based component

3. Wage deflated

The information set out on this website is of a general nature only and should not be taken as a complete or definitive statement about superannuation. You should not make decisions concerning your superannuation arrangements solely based on the information contained on this website which has been prepared without taking into account your objectives, financial situation or needs.