Federal Budget changes that provide more in retirement for more women

Lower paid women would have $40,000 more at retirement if at this year’s Budget the Federal Government committed to paying super on Commonwealth parental leave and re-aligning tax offsets, a new report has found.

The Super Members Council (SMC) report, Securing a Dignified Retirement for More Women, provides new insights into the drivers of the gender super gap, highlighting the urgency for both immediate, short-term actions in this year’s federal budget as well as substantive, long-term structural changes.

SMC is calling on the government to commit at this year’s Budget to the long-promised policy of paying super on Commonwealth Parental Leave Pay and to also increase the Low-Income Super Tax Offset.

SMC Interim Chair Nicola Roxon said poorly targeted tax concessions, the lack of super on paid parental leave and inequities in both pay and workforce participation rates are all persistent barriers to many women achieving economic security in retirement.

“Super has transformed the lives of millions of Australians, yet for many women, who retire earlier and live longer than men, the system is still falling short.” Ms Roxon said.

Women typically retire with a third less than men in super. Bridging this gender super gap will require considered, society-wide change over time. Yet there are long overdue actions the government could take at this Budget that would make a meaningful difference to retirement outcomes for women:

- Paying super on the Commonwealth Parental Leave Pay scheme could mean a mother of two is $12,500 to $14,500 better off at retirement. This would benefit thousands of working mums each year.

- Increasing the low-income superannuation tax offset (LISTO) so workers earning up to $45,000 receive a full tax refund on their super guarantee (SG) contributions. This change would boost the super of more than 1.2 million Australians – 60 per cent of whom are women.

New SMC cameo modelling shows combing these measures could add up to $38,000 to the retirement balances of lower paid women, boosting their final retirement balance by between 18% and 21%. (See Table 1 below)

“Paying super on parental leave and better aligning tax offsets for lower paid women can be enacted almost immediately and will make a meaningful difference to women at retirement,” Ms Roxon said.

“We need to ensure super tax concessions are directed to those who need it the most.”

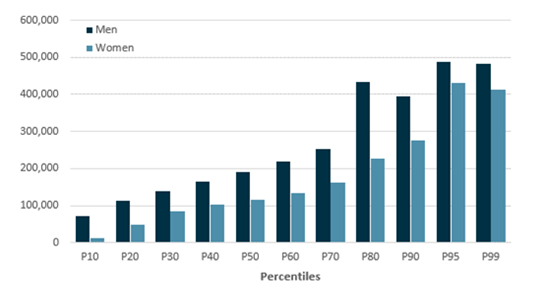

SMC analysis of tax data shows while men represent 51.5 per cent of taxpayers with a super balance, they receive 59.8 per cent of the tax concessions. Whereas women are 48.5 per cent of taxpayers with a super balance but receive only 40.2 per cent of the tax concessions.

Over the course of a lifetime men receive a far greater share of tax concessions compared to women.

“Clearly, lower income women are not getting their fair share of tax concessions. Lifting the LISTO is a first step towards rectifying that inequity,” Ms Roxon said.

“As well as fixing inequities in the super system broader measures will be needed to address the structural drivers of the gender super gap like lower workforce participation rates, the prohibitive cost of childcare, lower pay for feminised industries and the value placed on unpaid caring.”

“SMC will examine all factors big and small that contribute to gender inequity in super and advocate for changes that make super better, stronger and fairer for all Australians.”

The report adds further evidence to the many voices that have come before, including the Women’s Economic Equality Taskforce, to highlight the significant opportunity to improve equity in Australia’s world-class super system.

Table 1: Increase to retirement balance from paying super on Commonwealth Parental Leave Pay (PLP) and increasing the Low-Income Super Tax Offset (LISTO)

| Income Percentile | LISTO | LISTO + PLP | |||||||

| Dollar value | Per cent | Dollar value | Per cent | ||||||

| Men | Women | Men | Women | Men | Women | Men | Women | ||

| P10 | $11,135 | $13,957 | 4% | 11% | $12,116 | $26,403 | 5% | 21% | |

| P20 | $4,074 | $26,351 | 1% | 13% | $4,956 | $38,797 | 1% | 18% | |

| P30 | $4,545 | $12,559 | 1% | 4% | $5,428 | $25,005 | 1% | 9% | |

| P40 | $2,261 | $6,999 | 0% | 2% | $3,143 | $19,445 | 1% | 6% | |

| P50 | $0 | $7,221 | 0% | 2% | $882 | $19,667 | 0% | 5% | |

| P60 | $0 | $8,977 | 0% | 2% | $882 | $21,423 | 0% | 4% | |

| P70 | $0 | $10,567 | 0% | 2% | $882 | $23,012 | 0% | 4% | |

| P80 | $0 | $0 | 0% | 0% | $843 | $12,446 | 0% | 1% | |

| P90 | $0 | $0 | 0% | 0% | $845 | $12,338 | 0% | 1% | |

Source: SMC cameo model.

Chart 1: Increase in retirement balances from concessional taxation of super versus taxing at marginal rates, across income percentiles

Source: SMC cameo model.